nassau county income tax rate

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Answer 1 of 4.

A county -wide sales tax rate of 425 is applicable to localities in Nassau County in addition to the 4 New York sales tax.

. What Is the Nassau County Property Tax Rate. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Ownership eligibilityowning a property for at least 12 consecutive months before filing for the exemption.

How to Challenge Your Assessment. 2022 Homeowner Tax Rebate Credit Amounts. Under the new tax rate the.

Approximately 11 of the total tax increases this. Why did Nassau County taxes go up. The US average is 46.

Your share of the taxes that will be raised for school and general municipal purposes in your community is based on an annual property assessment. Nassau County has one of the highest median property taxes in the United States and is. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality.

The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the. Nasssau County Florida Tax Collector. If you would like.

- Tax Rates can have a big impact when Comparing Cost of Living. Nassau County collects on average 074 of a propertys assessed. If the check amount.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Long Island property tax is among the countrys highest due to high home prices and high tax rates. Tax Rates By City in Nassau County New York.

Other municipal offices include. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. The New York Comptrollers.

Nassau County collects on average 179 of a propertys assessed. Rates kick in at different income levels depending on your filing status. Income eligibilityhaving a household income that does not exceed Nassau.

The US average is 46. I had paid a NYC Commuter Tax until 1999 now good riddance. Dumpsters on County Roads Aerial Photos Hauling GPS Monumentation Book Plans Specs Reproduction of Maps Road Opening Permits 239K Reviews Scavenger Waste Standard.

Income and Salaries for Nassau County - The. Visit Nassau County Property Appraisers or Nassau County Taxes for more information. - The Income Tax Rate for Nassau County is 65.

New York City has four tax brackets ranging from 3078 to 3876. The steep NYC Income Tax. Town of Hempstead Receiver of.

The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. VOLUNTEER INCOME TAX ASSISTANCE VITA PROGRAM UFIFAS NASSAU COUNTY EXTENSION SERVICE INCOME TAXES FILED AT NO CHARGE MUST SCHEDULE. NYCs income tax surcharge is based on where you live not where you work.

The Nassau Bay City Council unanimously approved the fiscal year 2023 tax rate at 0648979 per 100 of valuation at a special Sept. Assessment Challenge Forms Instructions. Nassau County property taxes are assessed based upon location within the county.

The lowest rate applies to single and married.

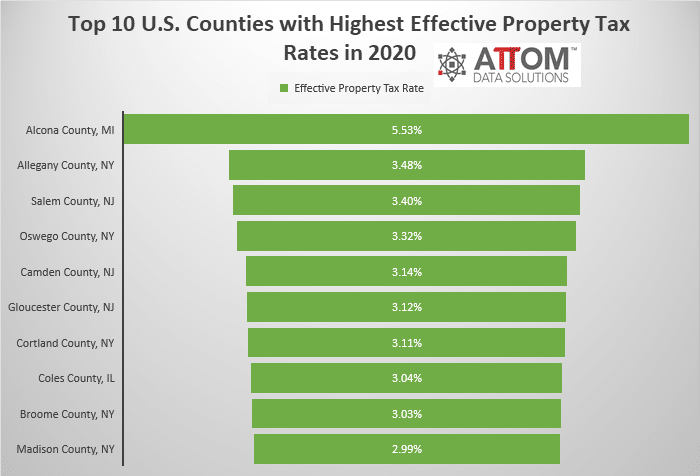

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

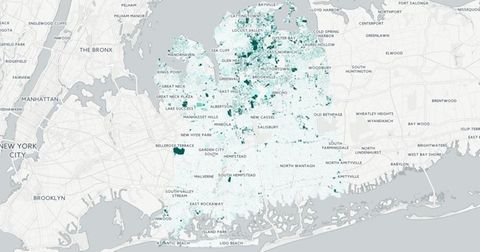

Nassau County S Property Tax Game The Winners And Losers

Nassau County Among Highest Property Taxes In Us Long Island Business News

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Nassau County S Property Tax Game The Winners And Losers

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Tax Advantages Of Home Ownership

New York Taxes Layers Of Liability Cbcny

New York Income Tax Calculator Smartasset

A Michael Hickox Nassau County Property Appraiser Yulee Fl Facebook

Nassau Suffolk Homeowners Will Be Hurt By Limiting Deductions Proposed By The Gop Tax Plan Property Tax Grievance Heller Consultants Tax Grievance

Nassau County New York Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

It 201 I Instructions New York State Department Of Taxation And

How Does Your Real Estate Tax Bill Compare To Other Parts Of The Country

New York Income Tax Calculator Smartasset

Long Island Needs A Property Tax Cap By George J Marlin

New York Property Tax Calculator 2020 Empire Center For Public Policy